Use the monthly budget sheet to set savings goals and compare your estimated vs actual costs each month. Fill out the sheet to get started and check back at the end of the month to see how you did.

Download budget sheetCheck out these helpful budgeting tips and tricks to get started.

In addition to the typical home costs like rent or your mortgage payment, every home requires basic repairs and upkeep. Help plan for any unexpected home projects by setting aside a little each month under the home repairs section of the budget sheet. So, when common home repairs are needed, you’ll be ready.

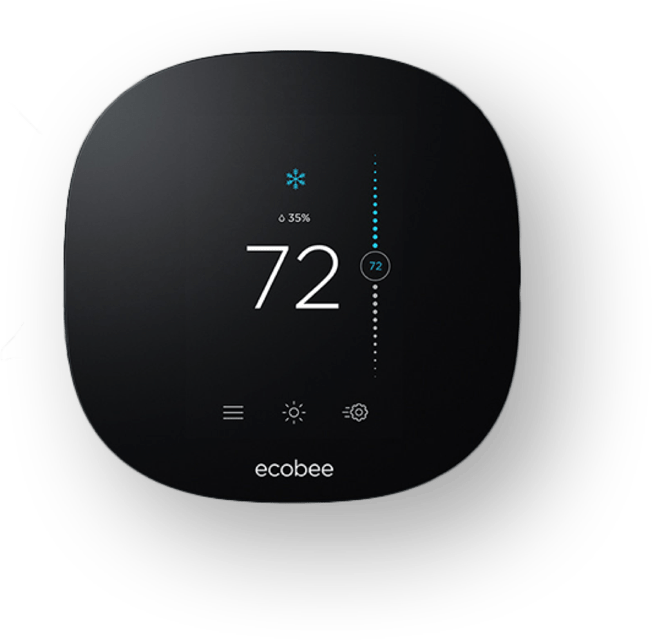

Investing in a smart thermostat can help keep utility costs down—yes, please! By using local weather reports and scheduled comfort settings, a smart thermostat can regulate the temperature of your home for optimal cost savings.

When budgeting for food each month, plan for a few meals out. But for most of your meals, consider browsing online for inexpensive and easy recipes to enjoy in the comfort of your home. You can make enough to have plenty of leftovers for the week, and you can look forward to your next family or date night out.

Travel is always more fun with company, even if you are going to and from the office. Consider saving on gas by carpooling with co-workers or friends. If that’s not an option, try shopping around online for competitive car insurance rates to see if you’re over paying each month.

Entertainment, clothing and extracurriculars are fun and easy to overspend on. One way to cut back on this expense is to use the envelope system. Try this by taking out a little cash each month that you only spend on fun things. When your envelope is empty, you know to hold off until next month.

Read this blog on what to do before buying your home.

Doctor visits, allergies, getting sick—it happens! For day-to-day costs like prescriptions, ask your doctor about possible generic brand medications as a less expensive alternative to name-brand drugs.

If you give every month to your favorite charity or organization, remember your time could also be a big help. Save some cash by volunteering at a soup kitchen or collecting donations. You’ll still be helping, and you can see your contribution coming to life.

As you work on your budget, consider discussing budgeting with your kids to teach them about saving money as a family. Encourage them to come up with fun money-saving ideas like packing lunches or having family movie nights at home.

Most people have debt and getting out of debt is possible. With careful planning, you may be able to lower your debt over time and eventually get rid of it altogether. You’re already off to a great start by using this budget sheet to find ways to save money.

As you work towards financial freedom, check out this blog on additional steps to take before buying your home.

Read blog

ENERGY STAR and the ENERGY STAR mark are registered trademarks owned by

the U.S. Environmental Protection Agency*

Trademarks of companies

other than Clayton are the property of those other companies.